![]()

Carbon Finance

Experience

Our carbon finance team reviewed 700+ projects in 46 countries, across various registries and project types. We worked with Verra, CAR, Gold Standard, California Offset Program, and Australian ERF/CFI. This was done for three major offset registries and private sector clients. We maintain extensive networks amongst mature and emerging project developers and institutional and corporate investors. Through our expertise in carbon finance, our team has approved the issuance of millions of offsets on behalf of Verra, CAR, and the California Compliance Offset Program.

Carbon Finance

Capabilities

We develop carbon finance sourcing strategies to meet client needs, identifying suitable geographies and project types. This includes selecting appropriate project development partners.

Identifying, Structuring, and Executing carbon finance agreements.

We conduct price discovery with analysis of supply volumes, timing, and pricing across project types and jurisdictions. This includes assessing buyer demand across all registries.

Our Due Diligence Typically Includes Assessing

Counterparty Risk

Carbon offset project developer teams: assessing track record, reputational risks, etc; Sourcing jurisdiction: identifying existing or future regulatory barriers (including Article 6 and local laws)

Regulatory/Program Risk

Risk inherent in the project type; Methodology related risks and identification of critical issues Review and provision of guidance on data, systems, processes, and project documentation;

Supply/Demand

Price discovery, including assessing project-specific timing / volume / vintages and desired pricing, and market analysis for supply / demand / pricing

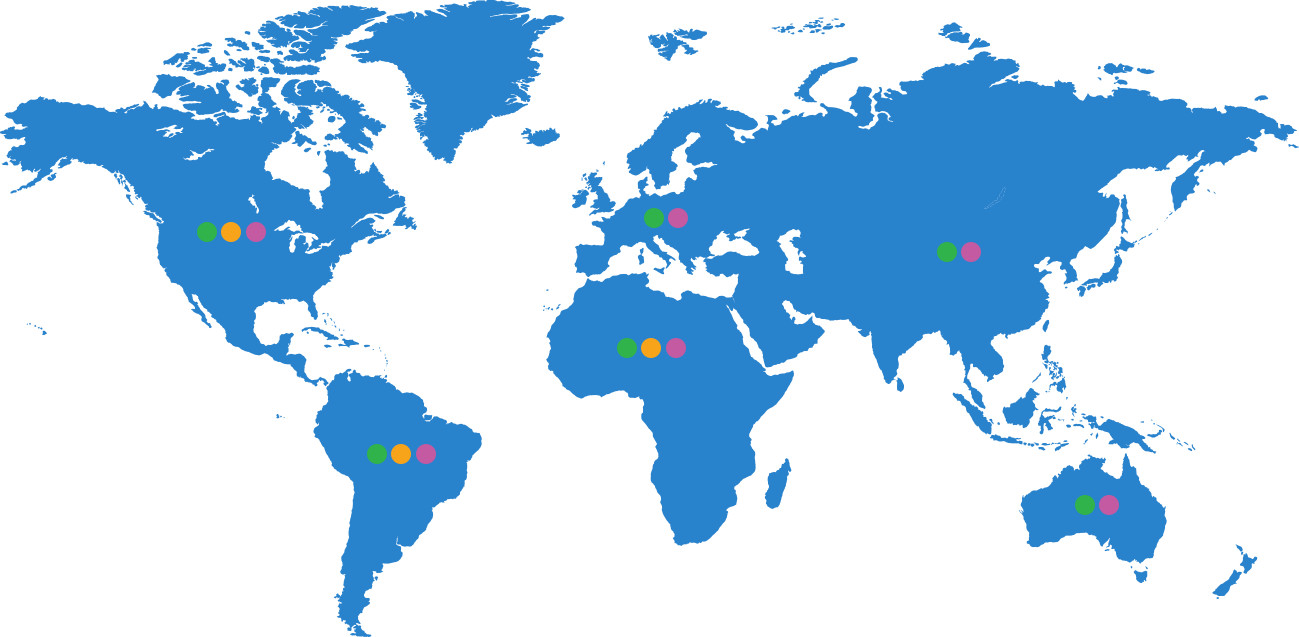

Countries for Which ATOA Carbon Has

Conducted Project Reviews

ATOA Carbon: 715 Worldwide

Project Reviews

Schedule Your Consultation Now!

Aside from our extensive experience and expertise, what stands us apart is our focus on identifying and mitigating risk, driving productivity, and communicating complex technical matters in plain English.